About us

Message from the President

Daiwa Fund Consulting Co. Ltd. started consulting for pensions in 1994 as a business of Daiwa Institute of Research Ltd. In July 2006, we spun off from Daiwa Institute of Research Ltd., expanding the scope of our research to investment trusts, providing investment advice for fund wraps, and expanding our business as a gatekeeper centered on alternatives.

We utilize the central research function to access various fund information of management companies around the world, and evaluate funds based on a unified standard through extensive and high-quality fund research. We provide one-stop solutions to client's concern about asset management, such as asset management consulting, investment advice for fund wraps (FoFs), and discretionary investment.

With "customer first" as our creed, we will strive to be a cutting-edge company with fiduciary duty.

April 2024

President

Takashi Fujikura

Company Profile

- Company name

- Daiwa Fund Consulting Co.Ltd.

- Address

-

-

Directions

GranTokyo North Tower

9-1, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-6756, Japan

-

- Establishment

- 25 July 2006

- Capital

- 450 million yen

- Shareholder

- Daiwa Securities Group (100%)

- Board of Directors

-

- President

- Takashi Fujikura

- Senior Executive Managing Director

- Hiroyuki Isokawa

- Senior Executive Managing Director

- Sei Nakagawa

- Executive Managing Director

- Morihiko Iwakoshi

- Executive Managing Director

- Shigeto Kashiwazaki

- Senior Managing Director

- Takuya Fujii

- Senior Managing Director

- Keigo Yokomizo

- Corporate Auditor

- Keiji Shibataki

- Corporate Auditor

- Motoi Sato

- Financial Instruments Firm

- Chief of Kanto Local Finance Bureau (Kin-sho) No.843

- Memberships

- Japan Investment Advisers Association

History

- 1994

- Began pension fund consulting (asset management) at Daiwa Institute of Research

- 1999

- Started investment trust evaluation

- 2006

-

Began fund of funds advisory services

100% subsidiary of Daiwa Securities Group

Registered as investment advisory company

- 2007

-

Launched evaluation of alternative investments, with a focus on hedge funds

Registered as financial instruments business (investment advisory and agency business)

- 2008

-

Started discretionary investment management business

Registered as financial instruments business (investment management)

- 2014

- Announced acceptance of the principles contained in Japanese Stewardship Code

- 2017

- Announced Basic Policy on Customer-first Operations as well as key initiatives

Key Figures

-

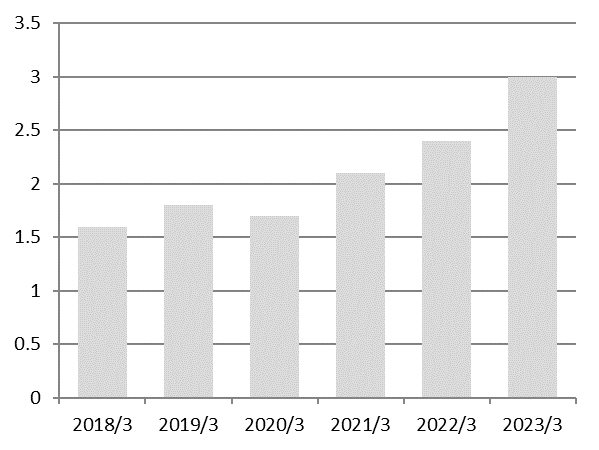

Asset balance for Daiwa Fund Wrap Select series

Approx. 3.0 trillion yen (end-Mar 2023)

-

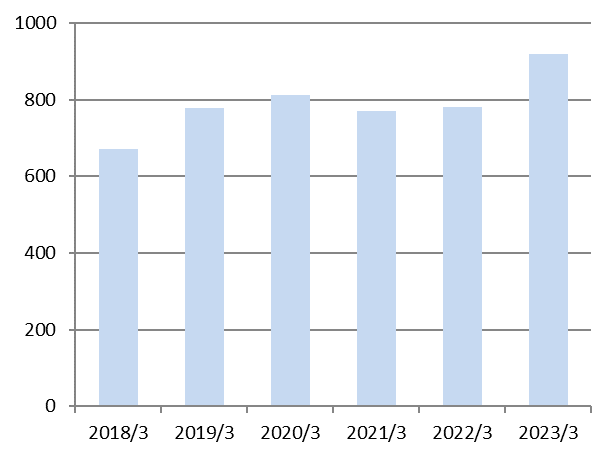

Assets under management for discretionary management service

Approx. 92 billion yen (end-Mar 2023)

Directions

-

GranTokyo North Tower

9-1, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-6756, Japan

- TEL

- 81-3-5555-6550

- Access from nearest train stations

- JR line: One-minute walk from Tokyo Station Yaesu North Exit (direct access from station)

- Subway lines: Four-minute walk from Tokyo Station Exit 2 (direct access from subway)

Four-minute walk from Tokyo Station Exit B7 (direct access from subway)

- By car

- Please use the underground Tokyo Station Yaesu parking lot.

Inquiries

-

Contacts for all inquiries:

- TEL

- 81-3-5555-6550

-

-

Regulation on Advertising, etc. (As of Financial Instruments and Exchange Law Article37)

If you decide to enter into a business arrangement with our company based on the information described in this material, we ask you to pay close attention to the following items.

- ●The fee for investment advisory/investment management services will be decided on a case-by-case basis on discussion with the investment party.

- ●If we go on a business trip on your request, we may charge you the actual expenses of the business trip. In such case, total costs can not also be specified beforehand.

- ●Major risks related to our investment advisory/investment management services include listed below,

- ・Changes in the market price of financial instruments based on fluctuations in interest rates, exchange rates, stock prices, real estate prices, commodity prices, and others, or change of the financial situation of issuers of the stock or bond may effect the market price of the asset class and lead to total or partial principal loss.

- ・Derivatives include risks that amount of the loss (or profit) set forth in the credit transaction and stock related derivatives could exceed the amount of your margin or any other security deposit, since the actual transaction may be larger than the security deposit.

Fees and Risk

When making an actual transaction, please be sure to carefully read the materials presented to you prior to the execution of agreement, and to take responsibility for your own decisions regarding the signing of the agreement with our company.