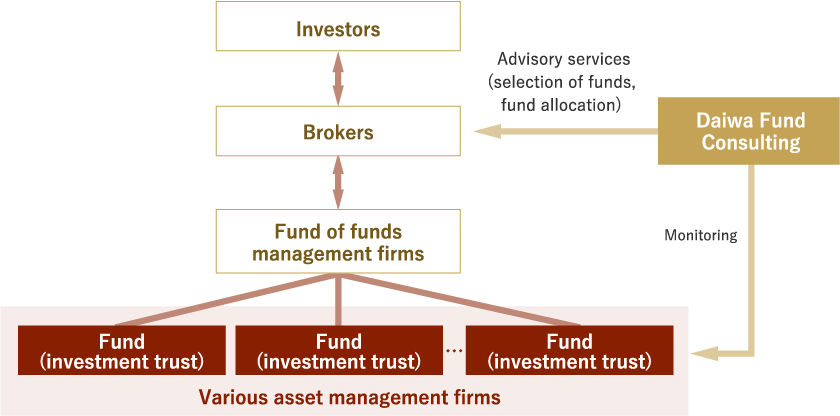

Investment Advisory Services

Fund wrap-focused management advice supporting asset formation

Over 10 years’experience (since 2006) providing fund of funds advisory services allows us to put together funds tailored to each client’s management style.

Advisory services for fund of funds

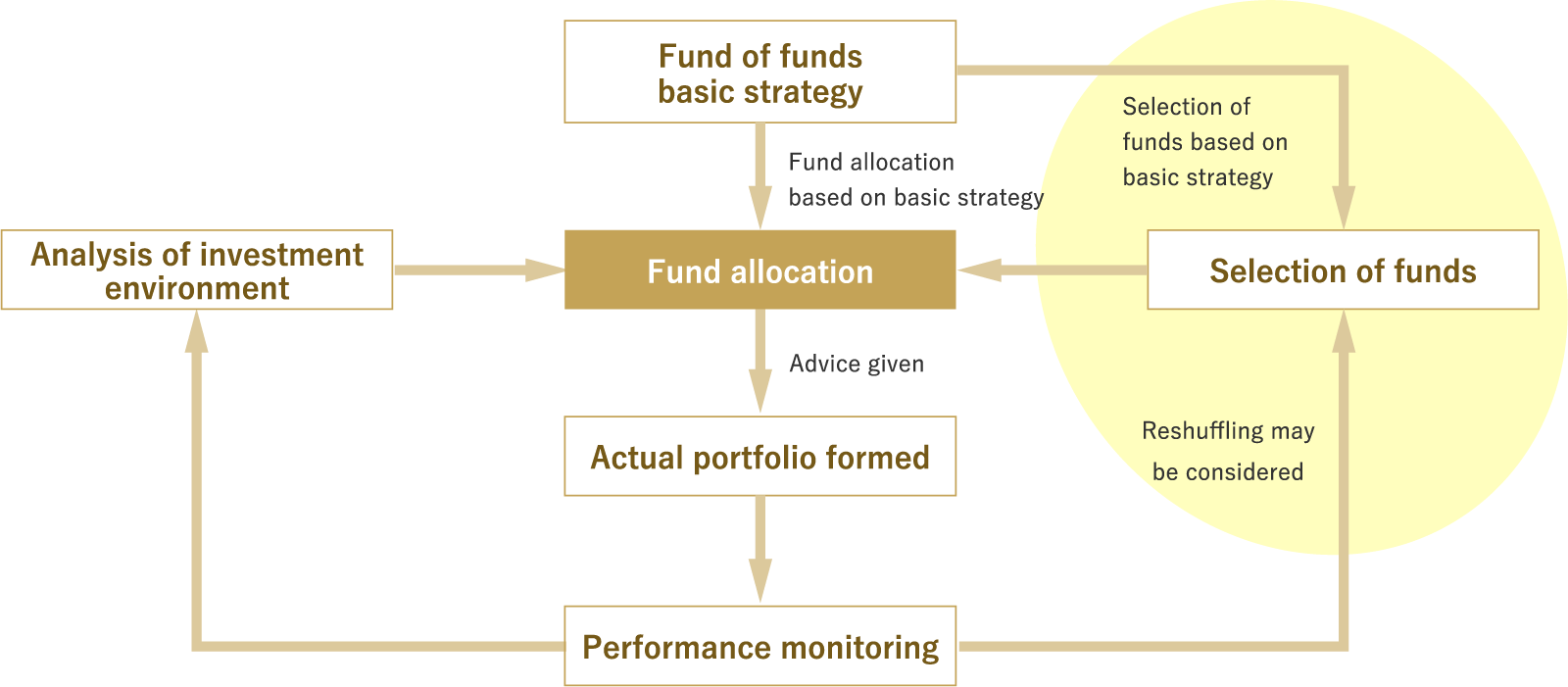

Investment Advisory Services based on Basic strategy

Basic strategy

(composition of fund, expected roles, allocation policy)

Selection of funds

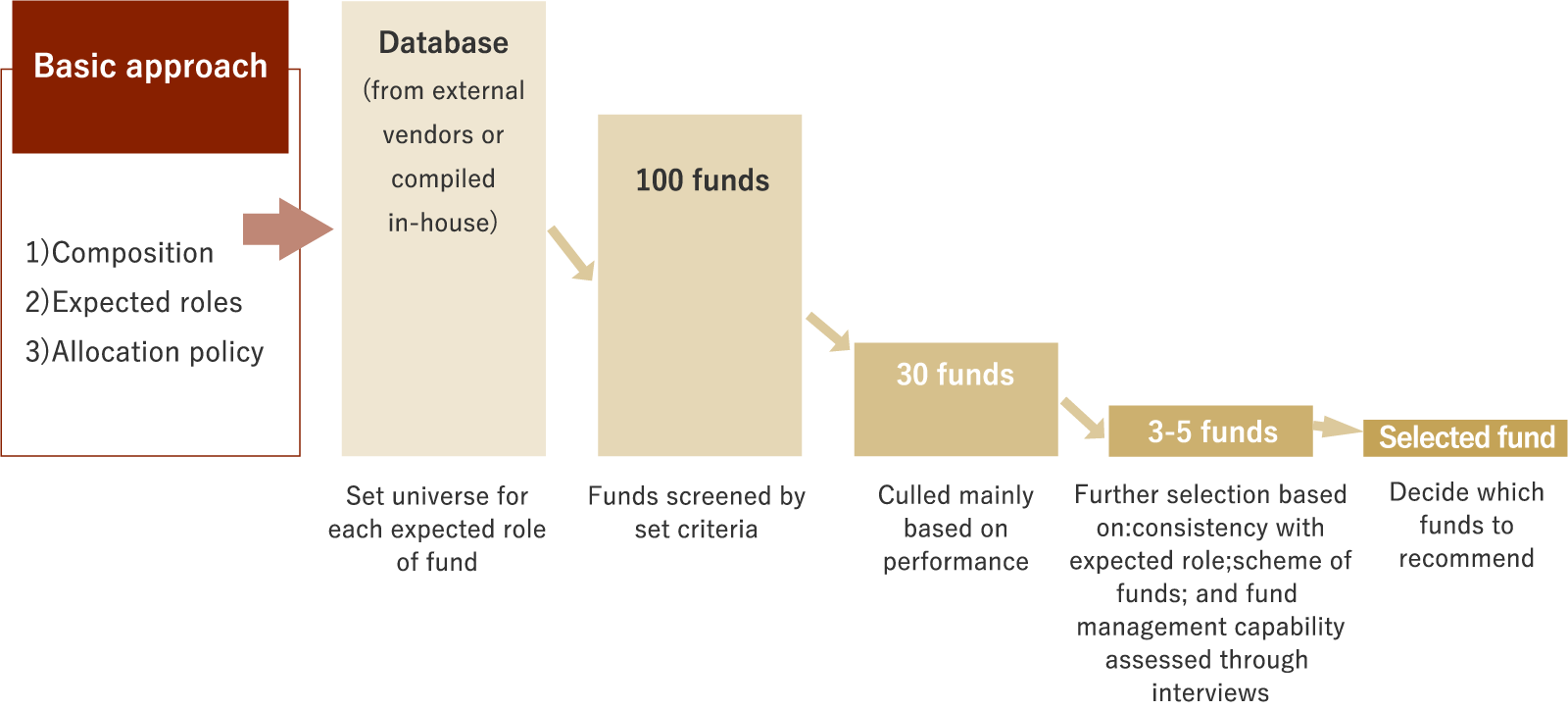

- Advise on appropriate management strategies based on various databases (e.g., data from external vendors as well as results of questionnaire surveys conducted by asset management firms)

- Narrow down funds through assessment based on interviews with asset management firms

Fund selection process (for each asset class)

Fund allocation

- Establish basic strategy for fund of funds. Selection of funds and fund allocation based on basic strategy.

- Investment in diverse and carefully-selected fund

Fund allocation process

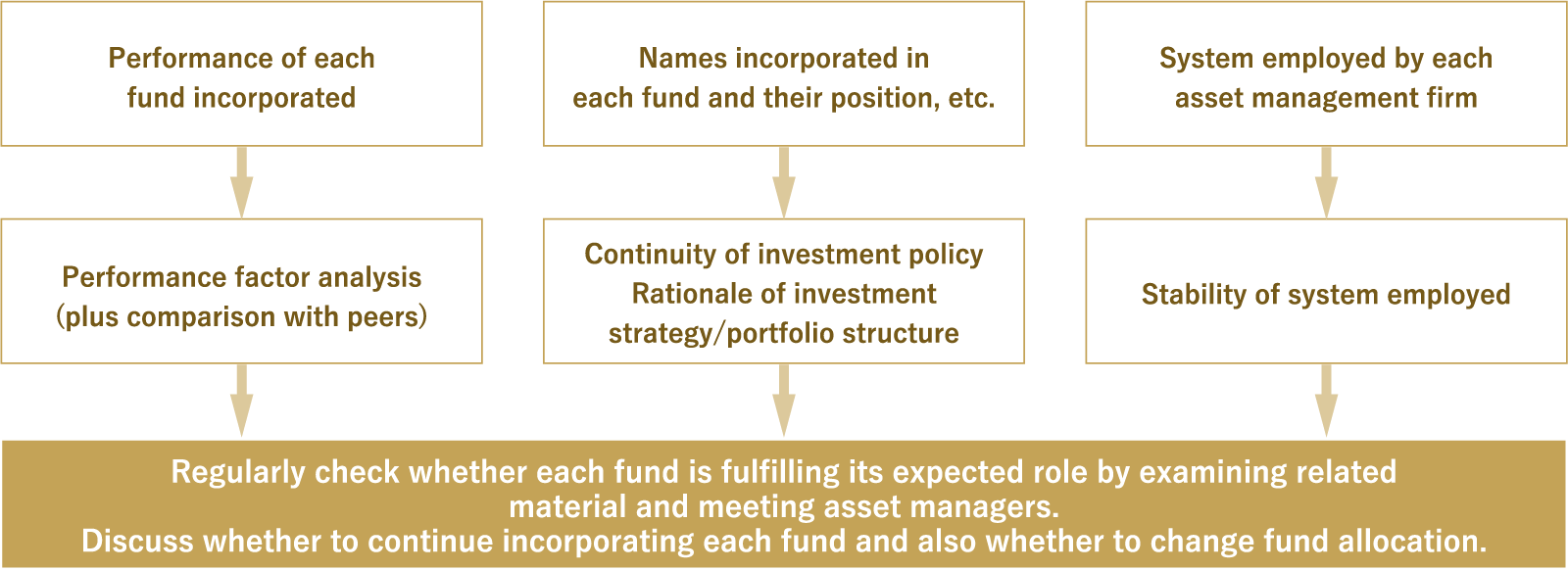

Performance monitoring

- Analysis of factors behind performance as well as comparison with peers.

- Check whether positions of names incorporated in each fund meet rationale of investment strategy by obtaining written information and interviewing asset managers

- Check continuity of asset management policy, stability of systems employed at asset management firms

Inquiries about Investment Advisory Services